Scroll down to continue reading this week’s most actionable corporate events, along with quick pitches on previously flagged setups, available in HTML format. For all past setups and pitches, please refer to the PDF file at the end.

This Week’s Most Actionable Corporate Events

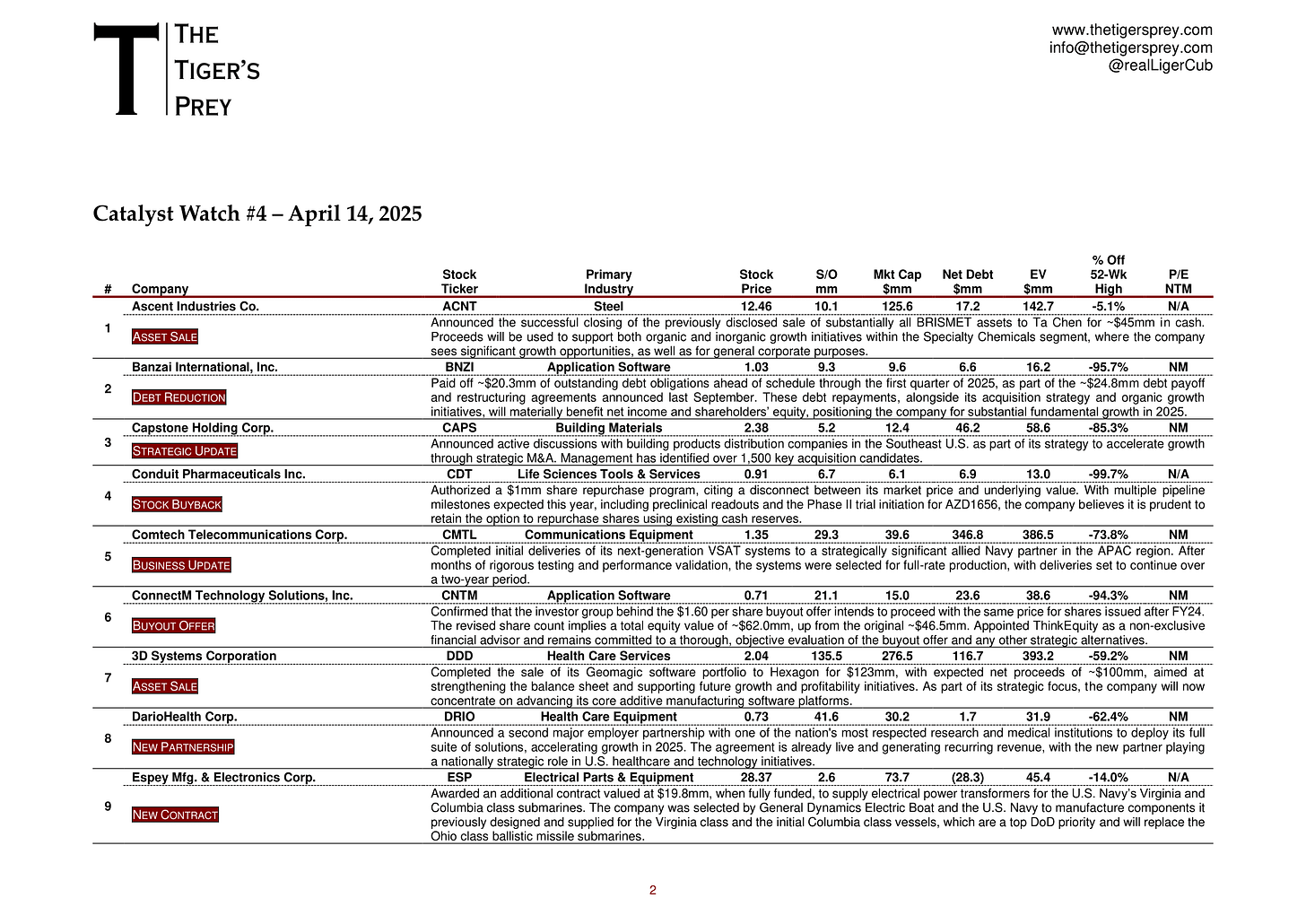

Ascent Industries Co. (ACNT) | Steel | $12.46 | $125.6mm

Asset Sale: Announced the successful closing of the previously disclosed sale of substantially all BRISMET assets to Ta Chen for ~$45mm in cash. Proceeds will be used to support both organic and inorganic growth initiatives within the Specialty Chemicals segment, where the company sees significant growth opportunities, as well as for general corporate purposes.

Banzai International, Inc. (BNZI) | Application Software | $1.03 | $9.6mm

Debt Reduction: Paid off ~$20.3mm of outstanding debt obligations ahead of schedule through the first quarter of 2025, as part of the ~$24.8mm debt payoff and restructuring agreements announced last September. These debt repayments, alongside its acquisition strategy and organic growth initiatives, will materially benefit net income and shareholders’ equity, positioning the company for substantial fundamental growth in 2025.

Capstone Holding Corp. (CAPS) | Building Materials | $2.38 | $12.4mm

Strategic Update: Announced active discussions with building products distribution companies in the Southeast U.S. as part of its strategy to accelerate growth through strategic M&A. Management has identified over 1,500 key acquisition candidates.

Conduit Pharmaceuticals Inc. (CDT) | Life Sciences Tools & Services | $0.91 | $6.1mm

Stock Buyback: Authorized a $1mm share repurchase program, citing a disconnect between its market price and underlying value. With multiple pipeline milestones expected this year, including preclinical readouts and the Phase II trial initiation for AZD1656, the company believes it is prudent to retain the option to repurchase shares using existing cash reserves.

Comtech Telecommunications Corp. (CMTL) | Communications Equipment | $1.35 | $39.6mm

Business Update: Completed initial deliveries of its next-generation VSAT systems to a strategically significant allied Navy partner in the APAC region. After months of rigorous testing and performance validation, the systems were selected for full-rate production, with deliveries set to continue over a two-year period.

ConnectM Technology Solutions, Inc. (CNTM) | Application Software | $0.71 | $15.0mm

Buyout Offer: Confirmed that the investor group behind the $1.60 per share buyout offer intends to proceed with the same price for shares issued after FY24. The revised share count implies a total equity value of ~$62.0mm, up from the original ~$46.5mm. Appointed ThinkEquity as a non-exclusive financial advisor and remains committed to a thorough, objective evaluation of the buyout offer and any other strategic alternatives.

3D Systems Corporation (DDD) | Health Care Services | $2.04 | $276.5mm

Asset Sale: Completed the sale of its Geomagic software portfolio to Hexagon for $123mm, with expected net proceeds of ~$100mm, aimed at strengthening the balance sheet and supporting future growth and profitability initiatives. As part of its strategic focus, the company will now concentrate on advancing its core additive manufacturing software platforms.

DarioHealth Corp. (DRIO) | Health Care Equipment | $0.73 | $30.2mm

New Partnership: Announced a second major employer partnership with one of the nation's most respected research and medical institutions to deploy its full suite of solutions, accelerating growth in 2025. The agreement is already live and generating recurring revenue, with the new partner playing a nationally strategic role in U.S. healthcare and technology initiatives.

Espey Mfg. & Electronics Corp. (ESP) | Electrical Parts & Equipment | $28.37 | $73.7mm

New Contract: Awarded an additional contract valued at $19.8mm, when fully funded, to supply electrical power transformers for the U.S. Navy’s Virginia and Columbia class submarines. The company was selected by General Dynamics Electric Boat and the U.S. Navy to manufacture components it previously designed and supplied for the Virginia class and the initial Columbia class vessels, which are a top DoD priority and will replace the Ohio class ballistic missile submarines.